DOGE Price Prediction: Path to $1 Remains Challenging Amid Technical and Fundamental Headwinds

#DOGE

- Current technical indicators show DOGE trading below key moving averages with weak momentum signals

- Mixed news sentiment reflects both ETF optimism and competitive pressures from utility tokens

- The $1 price target requires unprecedented growth of 374% from current levels amid significant resistance zones

DOGE Price Prediction

Technical Analysis: DOGE Shows Mixed Signals Near Key Support

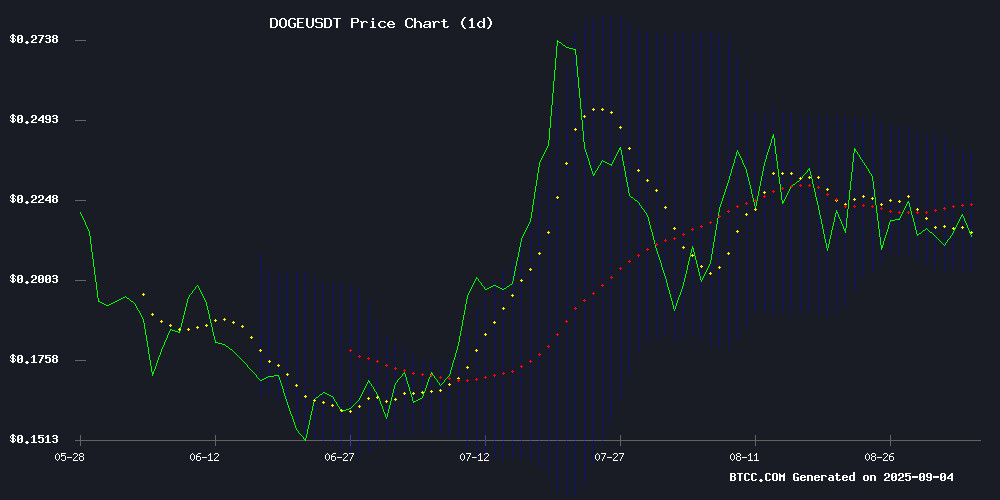

According to BTCC financial analyst Olivia, DOGE is currently trading at $0.21092, below its 20-day moving average of $0.22073, indicating short-term bearish pressure. The MACD reading of -0.000330 suggests weakening momentum, though the proximity to the Bollinger Band lower boundary at $0.202182 may provide support. Olivia notes that a break below this level could trigger further downside toward $0.19, while reclaiming the 20-day MA WOULD signal potential recovery toward $0.235.

Market Sentiment: DOGE Faces Headwinds Amid Shifting Investor Focus

BTCC financial analyst Olivia observes that recent news highlights a complex landscape for Dogecoin. While the first U.S. ETF filing has sparked bullish enthusiasm, increasing competition from utility-driven tokens like Remittix and the growing popularity of cloud mining alternatives are creating headwinds. Olivia suggests that these mixed fundamental factors align with the technical picture, indicating continued consolidation rather than explosive growth in the NEAR term.

Factors Influencing DOGE's Price

Dogecoin Price Faces Bearish Outlook as Investors Shift to Utility-Driven Remittix

Dogecoin's price trajectory has turned increasingly bearish, with analysts predicting stagnation around the $0.21-$0.22 range. Resistance near $0.225 remains a critical hurdle, and failure to breach it could see DOGE retreat toward $0.1362. The fading allure of meme coins has prompted holders to seek alternatives with tangible utility—enter Remittix.

Remittix, positioned as a stark contrast to Dogecoin's speculative nature, is capturing attention with forecasts of up to 5,500% growth. Its upcoming Q3 wallet beta launch and a $250,000 giveaway are shifting the narrative from hype to functionality. While Dogecoin clings to fleeting ETF-related optimism, Remittix offers a concrete value proposition that resonates in a market increasingly wary of empty momentum.

First U.S. Dogecoin ETF Filing Sparks Market Rally as Technicals Turn Bullish

REX-Osprey has submitted the first U.S. Dogecoin ETF application to the SEC, marking a watershed moment for memecoin institutionalization. The proposed REX-Osprey DOGE ETF (DOJE) would track the asset's performance through a mix of direct holdings and derivative instruments, bypassing the need for investors to custody tokens.

Dogecoin surged 2.68% to $0.22 following the announcement, completing a 122% annual gain despite a 30% YTD drawdown. Chartists note the formation of a bullish higher-highs pattern on weekly timeframes, with critical resistance levels emerging at $0.243 and $0.495.

The filing builds on REX-Osprey's track record with crypto investment products, including their pioneering SOL + Staking ETF. Market makers anticipate heightened volatility around the $0.20 support zone as regulators review the unprecedented memecoin offering.

Dogecoin Under Pressure: Price Squeezes Between Moving Averages

Dogecoin (DOGE) faces mounting pressure as its price struggles between key moving averages, trading at $0.21529—a 2.27% decline over the past 24 hours. The meme coin is testing a critical support level at $0.214, a battleground for buyers and sellers that has seen repeated tests.

September 4 saw consistent declines during Asian trading hours after DOGE faced rejection at $0.223. Binance data via TradingView shows the price hovering at $0.2143, while CoinMarketCap reports 24-hour trading volume at $1.78 billion.

A descending trendline of lower highs signals weakening buying momentum. The 50-day SMA (orange) now caps upside, while the 100-day SMA (blue) provides dynamic support—creating a technical squeeze that could force directional resolution.

Dogecoin Shows Mixed Signals as Volume Spikes Amid Price Fluctuations

Dogecoin (DOGE) posted a 4% gain over a 24-hour period, climbing from $0.216 to $0.218, but faced resistance at $0.223 amid expanding trading volumes. Institutional interest appears to be growing, with prediction markets now assigning a 71% chance of ETF approval—up from 51%—fueling speculation about broader adoption.

Price action revealed a tight trading range of $0.214 to $0.223, with midday rallies and late-session rejections signaling persistent volatility. A high-volume spike above 400 million DOGE confirmed corporate desk participation, while evening profit-taking pushed the meme coin back toward key support levels.

Technical analysts remain divided. Some warn of a breakdown toward $0.17 if DOGE fails to hold $0.214, while others see potential for a long-term rally toward $1.00–$1.40 based on historical patterns. The formation of lower highs and expanding sell-side volume suggest distribution, yet institutional bids continue to provide a floor.

Dogecoin Cloud Mining Gains Traction as ETHRANSACTION Simplifies Earnings

Dogecoin's recent 4% price surge has reignited market interest, though trading volume dipped 38.2% in the same period. Analysts note key support at $0.22 with resistance between $0.238-$0.26, suggesting potential for breakout momentum toward $0.40 if current trends hold.

ETHRANSACTION's cloud mining solution emerges as a disruptive force, eliminating hardware barriers with a streamlined platform. The service promises $21,200 daily earnings potential through automated Dogecoin mining, attracting investors with $19 sign-up bonuses and 24/7 managed operations.

Will DOGE Price Hit 1?

Based on current technical indicators and market sentiment, reaching $1 appears highly unlikely in the foreseeable future. At its current price of $0.21092, DOGE would need to appreciate by approximately 374% to achieve this milestone. The technical setup shows resistance at multiple levels, particularly around the $0.24 region where the upper Bollinger Band resides. Fundamental factors, including increased competition from utility tokens and the need for sustained ETF momentum, suggest that while gradual recovery is possible, the $1 target remains speculative without significant catalyst-driven adoption.

| Price Level | Distance from Current | Required Gain | Key Resistance |

|---|---|---|---|

| $0.24 | +13.8% | Moderate | Bollinger Upper Band |

| $0.30 | +42.2% | Significant | Psychological Level |

| $0.50 | +137% | Major | Previous ATH Region |

| $1.00 | +374% | Extreme | Speculative Target |